Simulated Panel-Data Set with Polynomial Factor Structure and endogenous regressors.

Simulated_KSS_Data_DGP2.RdA Panel-Data Sets with:

time-index : t=1,...,T=30

individual-index : i=1,...,N=60

This panel-data set has a polynomial factor structure (3 common factors) and endogenous regressors.

Usage

data(DGP2)Format

A data frame containing :

- Y

dependent variable as N*T-vector

- X1

first regressor as N*T-vector

- X2

second regressor as N*T-vector

- CF.1

first (unobserved) common factor: \($CF.1(t)=1$\)

- CF.2

second (unobserved) common factor: \($CF.2(t)=\frac{t}{T}$\)

- CF.3

thrid (unobserved) common factor: \($CF.3(t)=\left(\frac{t}{T}\right)^2$\)

Remark: The time-index t is running "faster" than the individual-index i such that e.g. Y_it is ordered as: \($Y_{11},Y_{12},\ldots,Y_{1T},Y_{21},Y_{22},\ldots$\)

Details

The panel-data set DPG2 is simulated according to the simulation-study in Kneip, Sickles & Song (2012): \($Y_{it}=\beta_{1}X_{it1}+\beta_{2}X_{it2}+v_i(t)+\epsilon_{it}\quad i=1,\dots,n;\quad t=1,\dots,T$\) -Slope parameters: \($\beta_{1}=\beta_{2}=0.5$\)

-Time varying individual effects being second order polynomials: \($v_i(t)=\theta_{i0}+\theta_{i1}\frac{t}{T}+\theta_{i2}\left(\frac{t}{T}\right)^2$\) Where theta_i1, theta_i1, and theta_i1 are iid as N(0,4)

The Regressors X_it=(X_it1,X_it2)' are simulated from a bivariate VAR model: \($X_{it}=R X_{i,t-1}+\eta_{it}\quad\textrm{with}\quad R=\left(\begin{array}{cc}0.4&0.05\\0.05&0.4\end{array}\right)\quad\textrm{and}\quad \eta_{it}\sim N(0,I_2)$\)

After this simulation, the N regressor-series \($(X_{1i1},X_{2i1})',\dots,(X_{1iT},X_{2iT})'$\) are additionally shifted such that there are three different mean-value-clusters. Such that every third of the N regressor-series fluctuates around on of the following mean-values \($\mu_1=(5,5)',\;\mu_2=(7.5,7.5)',\textrm{ and }\;\mu_3=(10,10)'$\)

In this Panel-Data Set the regressor X_it2 is made endogenous by the re-definition: \($X_{it2}:=X_{it2}+0.5 v_i(t)$\)

See Kneip, Sickles & Song (2012) for more details.

References

Kneip, A., Sickles, R. C., Song, W., 2012 “A New Panel Data Treatment for Heterogneity in Time Trends”, Econometric Theory

Examples

data(DGP2)

## Dimensions

N <- 60

T <- 30

## Observed Variables

Y <- matrix(DGP2$Y, nrow=T,ncol=N)

X1 <- matrix(DGP2$X1, nrow=T,ncol=N)

X2 <- matrix(DGP2$X2, nrow=T,ncol=N)

## Unobserved common factors

CF.1 <- DGP2$CF.1[1:T]

CF.2 <- DGP2$CF.2[1:T]

CF.3 <- DGP2$CF.3[1:T]

## Take a look at the simulated data set DGP2:

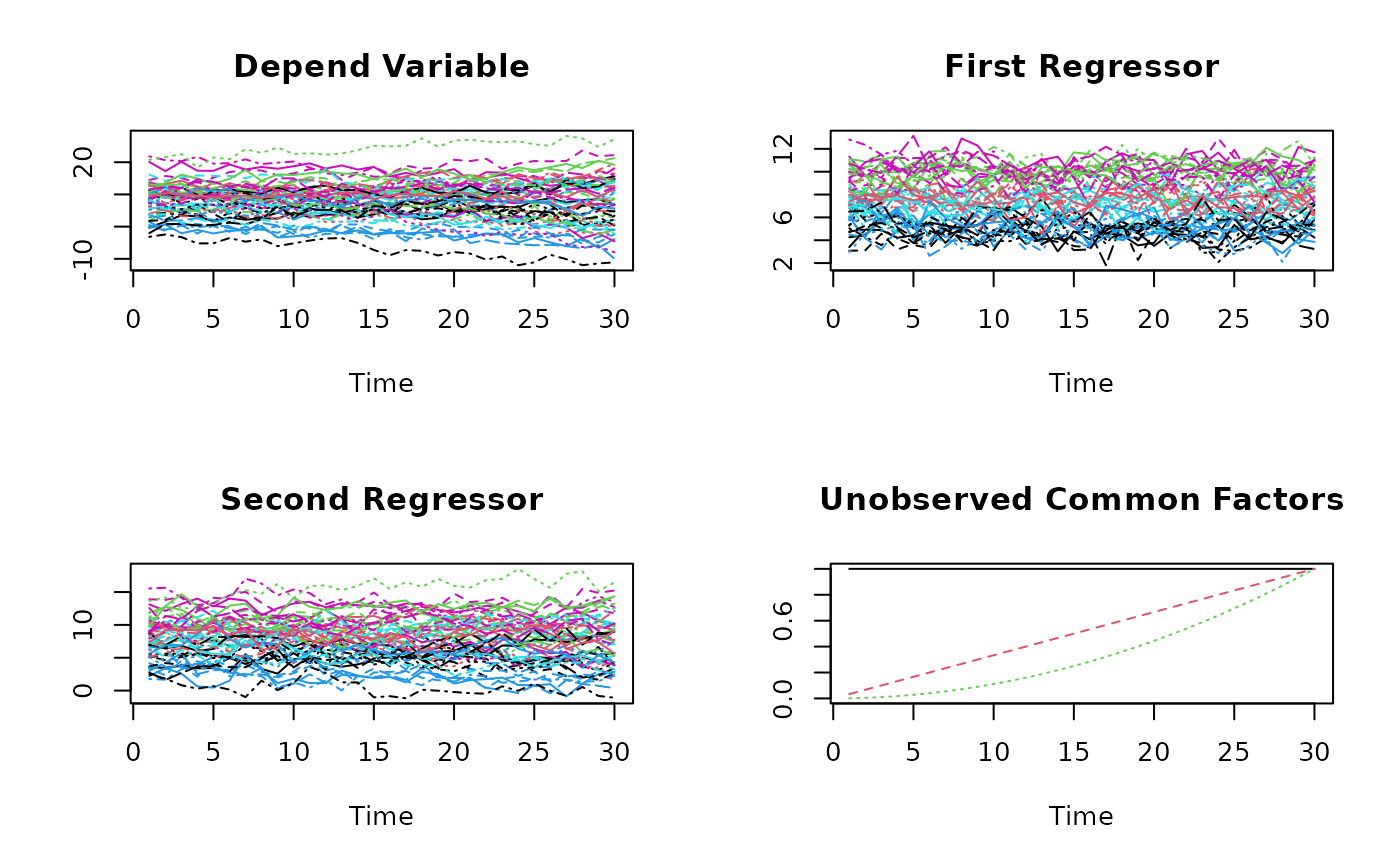

par(mfrow=c(2,2))

matplot(Y, type="l", xlab="Time", ylab="", main="Depend Variable")

matplot(X1, type="l", xlab="Time", ylab="", main="First Regressor")

matplot(X2, type="l", xlab="Time", ylab="", main="Second Regressor")

## Usually unobserved common factors:

matplot(matrix(c(CF.1,

CF.2,

CF.3), nrow=T,ncol=3),

type="l", xlab="Time", ylab="", main="Unobserved Common Factors")

par(mfrow=c(1,1))

## Esimation

KSS.fit <- KSS(Y~-1+X1+X2)

(KSS.fit.sum <- summary(KSS.fit))

#> Call:

#> KSS.default(formula = Y ~ -1 + X1 + X2)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -3.18 -0.70 0.00 0.68 3.45

#>

#>

#> Slope-Coefficients:

#> Estimate StdErr z.value Pr(>z)

#> X1 0.5470 0.0256 21.3 < 2.2e-16 ***

#> X2 0.4840 0.0248 19.5 < 2.2e-16 ***

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> Additive Effects Type: none

#>

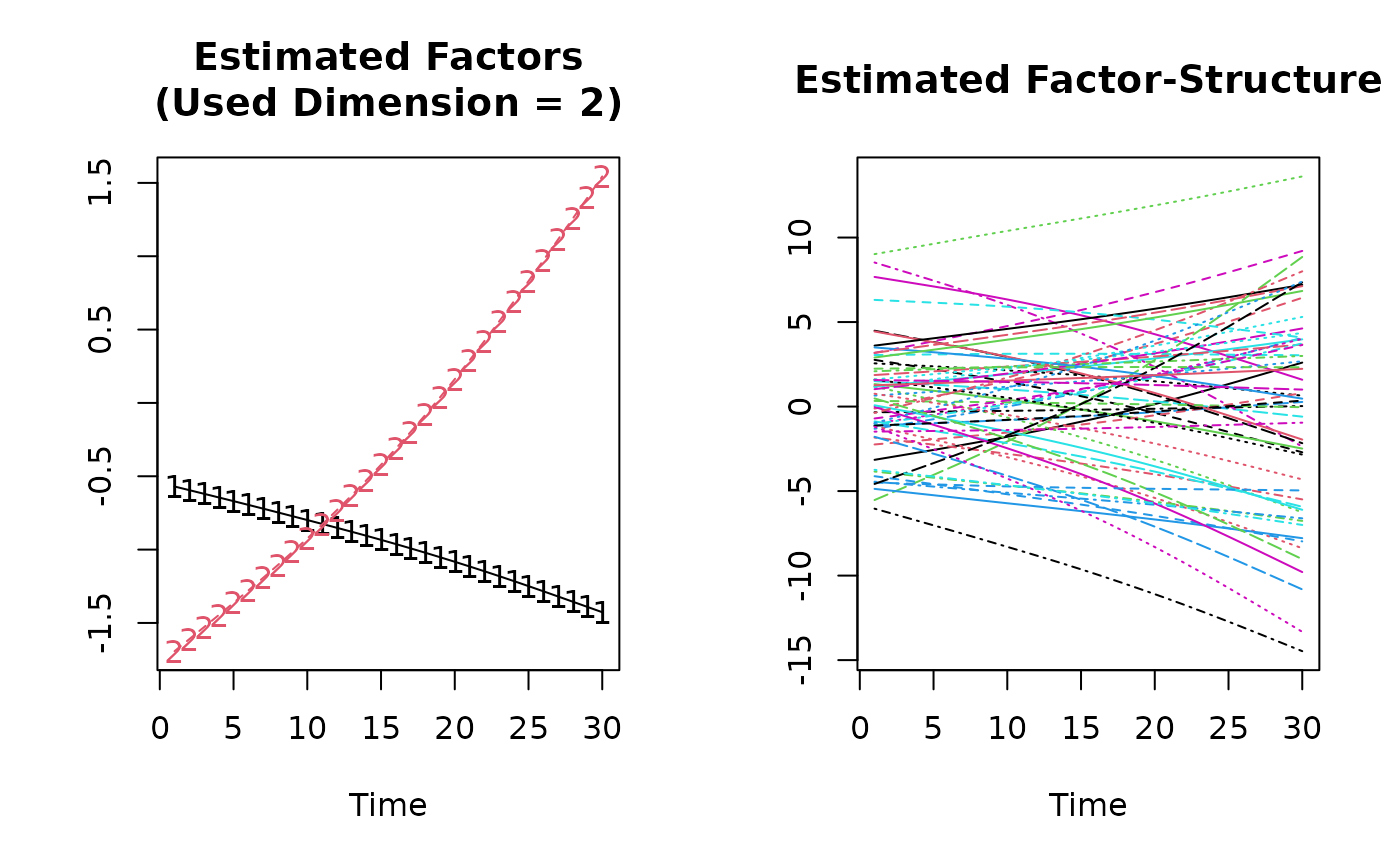

#> Used Dimension of the Unobserved Factors: 2

#>

#> Residual standard error: 1.09 on 1618 degrees of freedom

#> R-squared: 0.974

plot(KSS.fit.sum)

par(mfrow=c(1,1))

## Esimation

KSS.fit <- KSS(Y~-1+X1+X2)

(KSS.fit.sum <- summary(KSS.fit))

#> Call:

#> KSS.default(formula = Y ~ -1 + X1 + X2)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -3.18 -0.70 0.00 0.68 3.45

#>

#>

#> Slope-Coefficients:

#> Estimate StdErr z.value Pr(>z)

#> X1 0.5470 0.0256 21.3 < 2.2e-16 ***

#> X2 0.4840 0.0248 19.5 < 2.2e-16 ***

#> ---

#> Signif. codes: 0 ‘***’ 0.001 ‘**’ 0.01 ‘*’ 0.05 ‘.’ 0.1 ‘ ’ 1

#>

#> Additive Effects Type: none

#>

#> Used Dimension of the Unobserved Factors: 2

#>

#> Residual standard error: 1.09 on 1618 degrees of freedom

#> R-squared: 0.974

plot(KSS.fit.sum)